Childcare Voucher changes on the horizon

*Please note the information in this article may be out of date

The new tax-free childcare scheme being introduced will herald big changes in the amount parents will save

Sat, 06 Apr 2013The new Tax-free Childcare Scheme will replace the existing Childcare Voucher system from Autumn 2015. Parents already in receipt of vouchers can choose to stay on the old system, or move to the new one. We look at the advantages, or not, of each, to help you decide which is better for you. It's worth noting that specifics about the new scheme may change before its introduction in 2015.

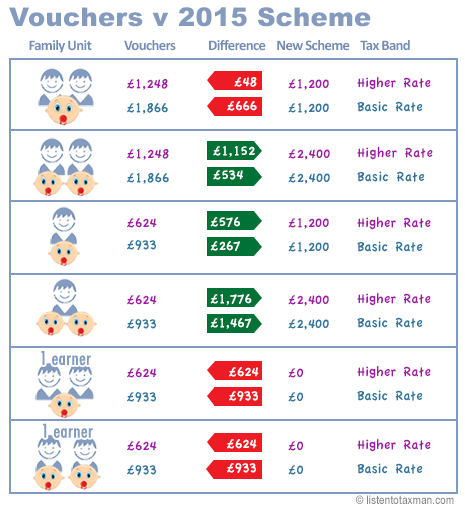

Existing Vouchers vs. New Scheme

Childcare Vouchers are paid for out of your pre-tax wage, meaning tax savings for parents. They are also National Insurance exempt. Under the present Voucher system, how much of a saving depends on the rate of tax payed by the parent. Vouchers can save each working parent up to £933 per year in tax and NI. Employers can save up to £402, per employee, in employers NI per year. As both parents can claim Vouchers under the present system, annual savings of up to £1,866 can be made in a household with two working parents.

Under the new Childcare Scheme, to be introduced in 2015, the government will be subsidising 20% towards a child’s registered childcare costs. The remaining 80% will be paid by parents. So, for every £100 paid for childcare, parents pay £80 and the government pay £20. This 20% saving can be made on the first £6,000 of childcare costs, giving parents a saving of £1,200 per child, per year.

The changes, announced during the March 20th budget statement, have caused much debate. In order for a couple to qualify for the new Tax-free Childcare Scheme, both parents must be working and paying tax. This is not the case under the present system, where one parent can claim the vouchers even if the other is not earning. There is no change for single parent households.

Also, under the new Tax-free Childcare Scheme, parents can initially only claim vouchers for a child up to 5 years of age instead of 16 years of age, as it is under the present Voucher system. Eventually it will apply to childcare for under 12s. Families with disabled children will be able to claim for children up to the age of 16.

One clear advantage of the new Tax-free Childcare Scheme is that it is not run through employers, meaning it will be open to more parents. At the moment, Childcare Vouchers are accessed through ones employers, limiting their availability to those who work where there is a Voucher system provided, and making them unavailable to the self employed. Under the new Scheme, parents do not have to rely on employers to offer the service. They will be able to choose a Childcare Scheme provider to manage their entitlement and childcare costs. Voucher providers, for example, Busy Bees Benefits, one of our site sponsors, will collect payments from the government on your behalf, and use them to pay for the registered childcare provider of your choice.

John Woodward, CEO of Busy Bees Group, said “We are pleased that the Government is continuing to support parents and recognise that the cost of childcare is a huge burden to those who work. Busy Bees Benefits is delighted to embrace the new Scheme, and is well placed to offer it directly to parents, due to our ability to adapt to the new market, our innovative online systems and our existing relationships with clients - not only those who already use Childcare Vouchers, but those 19,000 parents whose children attend one of the 213 Busy Bees nurseries every week. We will provide a service for everyone.”

Don't Miss Out

The present Voucher system will still be in existence until late 2015. This means that parents who are not at present using the Voucher system to help pay for childcare costs have time to sign up. In some cases, as we have highlighted in the table below, the present system will be more beneficial than the new Scheme. Under the new Scheme, families with two working parents and one child in childcare, will be worse off than those using Childcare Vouchers, by up to £666 a year.

Once the new Scheme is introduced, parents already in receipt of Childcare Vouchers have the option to stay on the old system for 5 more years, or move to the new Scheme. New parents applying for the Tax-Free Childcare Scheme at that point will not have the option of the older Voucher system.

If your employer does not offer Childcare Vouchers, putting them in touch with a Voucher provider, such as Busy Bees Benefits, will save both you, and your employer, money in tax and NI contributions. These providers manage the Childcare Voucher system on behalf of employers for a service charge. This charge is less than the savings an employer would make by offering Vouchers, making it cost effective.